These 3 things dim India's bright solar capacity growth

Debt tie-ups keep dragging the sector down.

India’s solar power addition is likely to see continued high traction in FY19, according to India Ratings & Research, given the declining tariffs and low variability in solar radiation patterns, and hence better PLFs predictability PLFs than wind, and government’s thrust on solar.

However, solar capacity addition could face challenges in: (i) debt tie-ups, (ii) additional equity requirement, (iii) land acquisition, (iv) evacuation infrastructure, and (v) power scheduling.

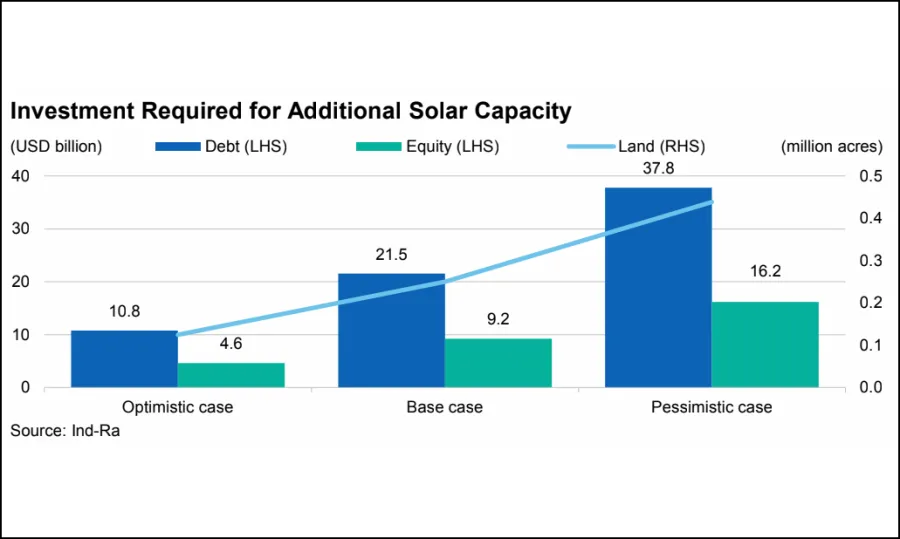

Ind-Ra believes for adding about 18GW of solar capacity annually till FY22, the total debt and equity requirement would be nearly USD40 billion and USD16 billion, respectively. This would test the risk appetite of both the bond/domestic banking system and international equity investors.

Here's more from Ind-Ra:

The solar capacity addition, apart from the capital and land constraints, continues to face issues with respect to counterparty financial health, grid unavailability and lower returns, among others.

However, the government has to a large extent attempted to mitigate counterparty risk in bids where Solar Energy Corporation of India Ltd or NTPC Vidyut Vyapar Nigam Limited is the counterparty. Even when the counterparty is a state discom, improvements in discoms’ cash flow, as highlighted above, have resulted in a shortening of the collection cycle.

If the recently imposed 70% safeguard duty on imported solar cells and modules applicable for a period of 200 days is converted into an anti-dumping duty for a period of five years, it would increase the cost of solar modules to USD0.5/W from USD0.30/W-0.32/W. This would increase the project cost to INR58 million/MW from the existing INR40 million/MW, increasing solar tariffs to INR3.3/kWh-3.5/kWh.

However, developers who had won projects but not ordered the modules would see the maximum increase in the project cost and hence would have to rely on equity infusions from the promoters to make the projects viable.

Advertise

Advertise