Thermal coal prices to dip to $85 per tonne as demand dwindles

South Korea’s government is raising taxes on thermal coal by 27% in 2019.

Thermal coal prices are forecasted to slip to around $85/tonne for 2019 from $99/tonne in February, according to Fitch Solutions. The move comes after a price rally in Q1 brought about by a mining accident in Shaanxi and resulting mine closures, on top of poor weather restricting supplies from Indonesia may be short-lived due to supply-side issues waning demand from main importing nations.

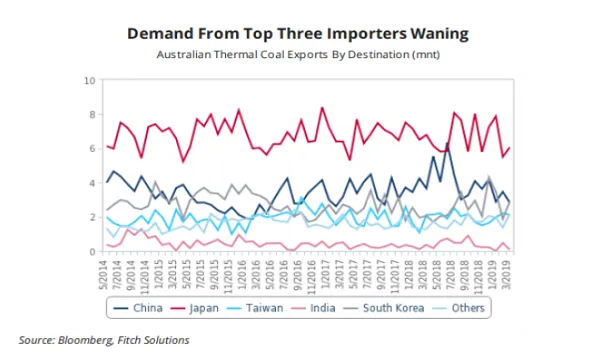

On the demand side, Japan, which accounted for 39% of Australian coal exports in 2018, is toughening its environmental stance, with Japan’s environment minister Yoshiaki Harada announcing in March that the construction or expansion of new coal-fired power plants would not be approved.

“In the country's bid to shift away from coal towards renewables, two coal-fired projects were cancelled YTD, reducing Japan's coal-fired power pipeline from roughly 13GW to 4GW only,” Fitch Solutions noted.

Also read: Mitsubishi UFJ Financial Group to cease coal financing

South Korea, accounting for approximately 15% of Australian thermal coal, is also following suit after the the government raised taxes on thermal coal by 27% in 2019.

Additionally, China, which accounted for 24% of Australian coal exports in 2018, has shown lacklustre demand for seaborne coal YTD, Fitch Solutions noted. Coupled with lengthy delays of up to three months in port clearing of Australian thermal coal due to heightened inspections and import curbs and buyer incentives to switch to other suppliers, demand from China has dwindled. Additionally, local supply is reportedly ample due to mine upgrades and expansions, further dragging down export demand.

“With the ongoing trade war with the US, and government attempts to curb the slowdown in economic activity, China has added 194 million tonnes of coal mining capacity in 2018, bringing the country's total capacity at the end of the year to 3.53 billion tonnes,” Fitch Solutions highlighted. “This is despite the number of coal mines shrinking as the country has shut down a significant number of smaller, more polluting and inefficient mines.”

Meanwhile, the National Environment Agency (NEA) has approved another seven coal mining projects with combined capacity of 22.5 million tonnes since the beginning of 2019. High frequency indicators showed that Chinese imports of thermal coal (from all sources) declined by 8% YoY in Q1 2019.

Asia is expected to be the principal driver of global demand growth, with demand in the US and Europe largely stagnant. In absolute volume terms, China and India will have the largest impact on the global coal market balance.

“We forecast thermal coal production in China to stagnate at 0.5% growth per annum from 2019 onwards, but not decline, as new coal mines in Inner Mongolia, Shaanxi and Shanxi provinces offset mine closures in the rest of the country,” the firm added.

Advertise

Advertise