C&I projects take up 22% of India's solar installations

6.5GW of solar capacity in this segment has already been installed.

The commercial and industrial (C&I) segment has about 6.5 GW of solar capacity installed which is nearly 22% of all solar installations, according to a report by JMK Research & Analytics.

The C&I segment holds about 70% of all rooftop solar installations (nearly 3GW) in India whilst in the utility-scale solar market, it has about 13% share (>3.5GW) under third-party sale/open access (OA)/captive model.

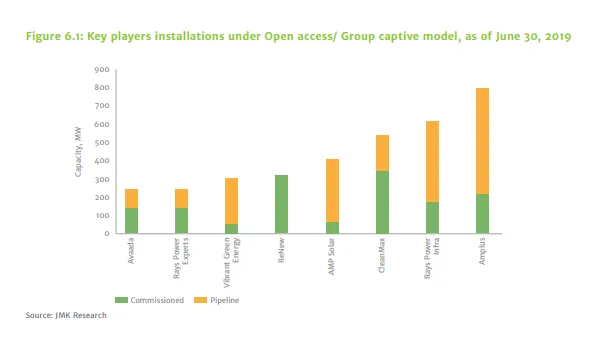

Earlier, most third-party sale/OA solar projects in India were installed by mid-size regional players focused only on specific states where they have easier access to land and have favourable open access policies. “Ujaas, Enrich, and Rays Experts are such players which from the last four to five years are developing projects under this model only,” said Jyoti Gulia, one of the report’s authors.

ReNew, CleanMax, Avaada, AMP Solar and Amplus are new additions to this list which have started building OA solar projects in the last two years. In Karnataka alone, Renew has built about 160 MW, Amplus has a portfolio of 220 MW, Avaada built 145 MW and Rays Power Infra built 130 MW. CleanMax has also constructed about 224 MW OA projects in Karnataka and 22 MW in Tamil Nadu.

Karnataka was instrumental in accelerating the growth of OA solar projects as it has offered waivers on most open access charges in the state, Gulia noted. However, the local government has not extended these waivers beyond the deadline of 31 March 2018.

After Karnataka, the next key state which has now picked up momentum in OA market is Haryana. In July 2019, Haryana Vidyut Prasaran Nigam Limited (HVPNL) has approved more than 500MW of projects under the Group Captive model which is a preferred power procurement model for C&I consumers, the report said.

“Under this model, a power consumer holds at least 26% of the equity ownership and projects are completely exempted from Cross Subsidy Surcharge (CSS) charges- the biggest component of OA charges. For this scheme, more than 1,916MW of applications were received,” Gulia said.

The report added that the third-party sale model is also picking up as C&I segment needs cheaper power. However, DISCOMs’ approvals for OA projects remain the biggest hurdle as C&I segment is the biggest contributor to DISCOM revenue.

“Any shift towards other sources of power will lead to a loss for DISCOMs. Other than this, there is also complete uncertainty about the future of OA charges (including transmission and distribution charges, additional surcharge, etc). All these hurdles still question the long term viability of these projects,” Gulia concluded.

Advertise

Advertise