Developing markets may turn to East Asia for coal investments

Banks in many developed markets have ceased investments in coal.

Developing markets may likely turn to markets like China, Japan and South Korea for seeking out investments in coal power, as pushback against the fuel type arise in many other developed markets, according to a report by Fitch Solutions.

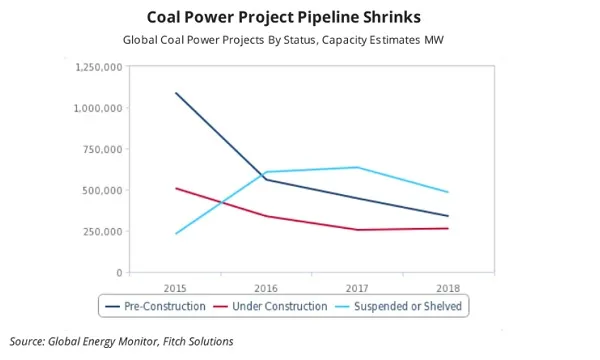

The rising international pressure has compelled banks to set a policy to cease funding coal power projects, which has resulted in limited options for funding by smaller developing markets.

“Whilst some of these banks have financing loopholes and exemptions in light of a project's importance to economic development, under the guise of the growing use of clean coal technologies, or indirectly via other banks and intermediaries, we expect that global scrutiny and pressure regarding these loopholes will intensify,” the report stated.

As a result, the markets are expected to look towards securing investments from countries where there is less pressure towards coal power projects. Notably, investments from China, Japan and South Korea can continue to stimulate demand for their own domestic coal power equipment and development capacity.

However, these sources of funding are expected to decline over 2020 onwards. Concerns arose over the long-term viability and return on investment of such projects in developing markets, as many have failed to advance or face increasing opposition.

For example, China's Green Belt and Road Initiative (BRI) is expected to shift towards investing in renewable power projects more because of its lower risk and financial viability rather than a focus on limiting carbon emissions.

In addition, Myanmar's 2015 Energy Master Plan (EMP) initially had a strong project pipeline of proposed coal facilities, but there has been limited progress on commissioning coal projects due to widespread opposition and the political sensitivity surrounding the sector. This has also led to several major project cancellations across 2018 like the Hpa-An Coal Plant.

Advertise

Advertise