Residential use drives Asia Pacific's power demand

Bill shock could occur in countries with rising block tariffs.

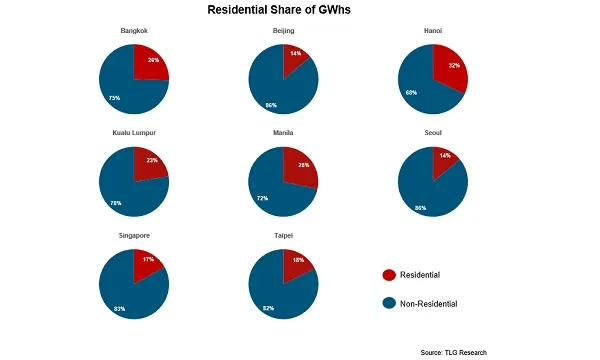

Residential demand for electricity has been on the rise in most countries in Asia Pacific due to stay-at-home working, affecting around 15-30% of overall load, according to a presentation by The Lantau Group.

In China, residential use climbed 10.2%. However, consumption from the secondary industry plummeted 92.9%, whilst the hospitality sector consumption also fell 23.1%.

With the rise in residential demand, residential “bill shock” is expected to be an issue, especially for countries with rising block tariff that is more common in Asian economies to help subsidise costs below cost-reflective levels for low consumption groups.

The period in February through May also has highly variable weather, and those are considered to be the peak period for markets like the Philippines. This will cause residential bill shock in the Philippines, for instance, to be much greater.

Meanwhile, a reduction in demand from commercial and industrial (C&I) customers would translate into utilities losing more money relative to costs, when C&I sales drop, and make less money relative to costs when domestic sales increase.

At the same time, a reduction in fuel costs amidst lingering recession could bring potential savings for a given fixed tariff, if actual fuel costs are less than embedded fuel costs in the tariffs.

Which would win between the two factors will depend on the duration and magnitude of each factor. “Smoothing mechanisms could spread tariff “pain” over time, but some regulatory arrangements that exist currently have no formal longer-term cost-recovery mechanism for non-capex factors to cater for COVID19 related demand reduction,” Lantau Group noted.

The presentation noted that future tariff reforms and increases may be needed the more the pandemic results in unrecovered costs or accrued losses for utilities. This could accelerate behind-the-meter developments.

“[This is] especially if/where domestic customers are protected in favour of raising more revenue from C&I customers and if fuel prices recover,” Lantau Group added.

Advertise

Advertise