Three reasons why India's renewables market is thriving

It ranked as the top emerging market for clean energy investment.

Ambitious targets, comprehensive government policies and economics have placed India amongst the most vibrant clean energy markets in the world, according to a white paper by Bloomberg Philanthropies and BloombergNEF (BNEF).

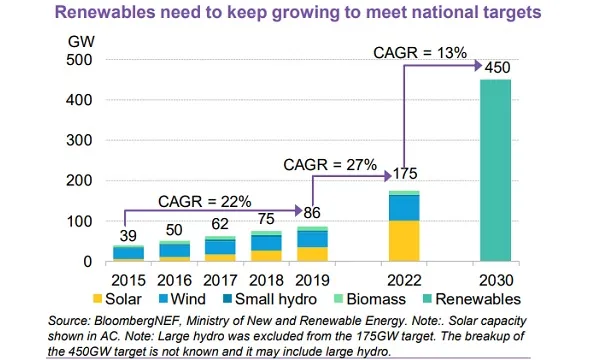

India is currently ranked as the top emerging market for clean energy investment by BNEF’s Climatescope, reflecting the policies introduced by its government to meet a goal of 450GW clean energy by 2030, its openness to investors, and the volume of renewables auctioned in recent years.

The country’s renewables market and clean power goals are even projected to double the share of zero-carbon electricity it would generate over the next decade. Through the competitiveness of renewables, attaining these goals would save over $78b in power system costs and avoid 2,860 million tonnes of carbon emissions.

The transition represents a $410b investment opportunity in new power generation capacity, whilst $240b of investment in transmission and distribution infrastructure will be needed to accompany this growth.

“The 2030 target brings momentum to the goal of capturing more value from the transition domestically... The wind sector has already seen leading equipment manufacturers open factories to supply the national and international markets,” the report noted.

In 2015, India announced a target of building 175GW of clean energy by 2022, rising more than fourfold in installed capacity in just seven years. By 2030, Prime Minister Narendra Modi expressed that he wanted India to reach a new goal of 450GW of renewables. This will require a flexible power system—apart from battery storage and peaker gas plants, demand-side measures, grid investments and market reforms will also be necessary

Still, the country is the world’s largest and most competitive clean energy auction market, allowing it to procure some of the cheapest renewable power. New auction designs would also allow the replacement of fossil fuels through better integration.

“The transformation of India’s power sector in this decade brings a $633b investment opportunity. Capital is needed to build more power plants, and also to replace and expand grid infrastructure. Public and private finance will need to mobilize to deliver these investments,” the report noted.

The report stated that the country’s rapid progress in sustainable economic growth and clean energy can be a model for nations looking to recover from the Covid-19 pandemic through the adoption of green stimuli that maximise economic, health, and environmental benefits.

“Investment in clean energy goes hand in hand with economic growth. India is a great example of that, and with its ambitious goals for the years ahead, India’s policies have helped to make it the number one ranked emerging market for clean energy investment,” said Michael Bloomberg, founder of Bloomberg and Bloomberg Philanthropies.

Advertise

Advertise