Over $13b of wind turbine capacity ordered in Q1

Wind turbine orders for the global onshore market made up 85% of Q1 capacity.

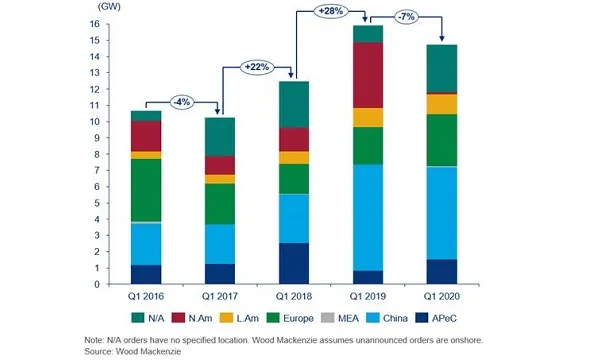

Wind turbine capacity saw nearly 14GW of orders globally in Q1 which equates to an estimated $13.4b, according to Wood Mackenzie’s analysis. This is said to be the second-highest first quarter on record.

Wind turbine orders for the global onshore market made up 85% or 12.6GW of capacity in Q1.

Nine of the top 10 onshore wind turbine models sold during Q1 were introduced within the past two years, underscoring the rapid pace of technology evolution, evolving customer needs and competitive product positioning.

“Positive momentum from order negotiations in 2019 largely eased the potential severity of the pandemic’s impact on order intake in Q1,” said Luke Lewandowski, Wood Mackenzie Research Director.

Meanwhile, developers in China logged a feverish fifth consecutive quarter of more than 5GW. Chinese demand has started to wane this year due to the impending expiry of China’s onshore subsidy coupled with the impact of the pandemic in Q1, added Lewandowski.

Further, orders for projects in Japan and Taiwan accounted for 33% of Q1 global offshore wind turbine order intake and 42% of overall offshore demand in Asia Pacific, excluding China. MHI Vestas captured the entirety of this demand for offshore projects.

Vestas led all OEMs with 3.3GW of announced wind turbine order intake in Q1, capturing 1.9 GW in the EMEARC region, the largest haul per region of any OEM.

Vestas’ V150-4.2 model sold the most capacity onshore, whilst Envision sold the most units (248) for its onshore EN-141 model. In the offshore sector, Goldwind captured the most capacity and highest number of units sold with its GW171/6450 model.

The deployment of higher-rated turbines continues to accelerate onshore, with the sector making up 45% of demand for models rated 5 to 6.99MW over the same period.

“A similar trend is occurring in Asia’s offshore sector, with average turbine rating and rotor diameter increasing year-over-year for projects in China where policy and environmental conditions necessitate a slower pace of technology evolution,” said Lewandowski.

However in Taiwan, developers have already jumped to 9.0-9.99-MW turbine models.

Advertise

Advertise