Japan's offshore wind development hampered by high costs

About 80% of the country's potential sites would require floating turbines.

Despite the growing momentum, Japan’s offshore wind sector faces challenges including the number of false starts in this sector over the last few years and its relatively higher cost of power generation, according to a report from Fitch Solutions.

Japan has launched a policy bill for offshore wind, setting out a framework and regulations to boost development of the sector across 30 potential locations by 2030. It has also launched its first offshore wind tender in June, for the Goto project off the southern prefecture of Nagasaki.

The Global Wind Energy Council and the Japan Wind Power Association have also formed a joint Japan Offshore Wind Task Force to drive offshore wind growth in Japan.

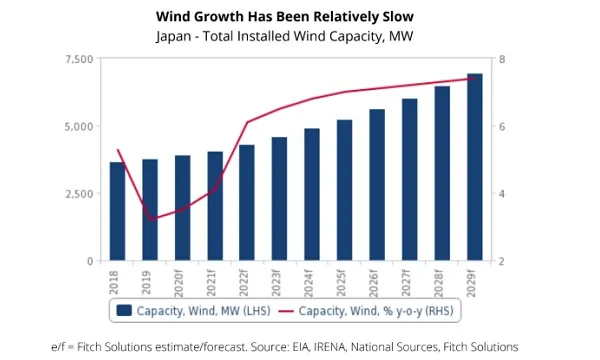

The increased focus on offshore wind could benefit the relatively nascent sector, the report noted. However, Fitch remains cautious until more concrete project developments come out, as investor uptake remains fairly limited despite government initiatives to boost the sector. As at end-2019, Japan only had about 65MW of offshore wind capacity

A key issue that needed to be addressed is the relatively high cost of power generation compared to other alternatives such as solar power, or thermal sources, largely blamed on the lack of economies of scale for offshore wind in Japan. Existing supply chains fall short of supporting a substantial ramp-up and drive down costs, the report noted.

“Building such capacity takes time, and more domestic expertise will be required for Japan to realise its offshore wind potential. Furthermore, Japan’s environmental impact assessment processes take up to five years, and are relatively expensive, which reduces the sector’s competitiveness,” Fitch said.

Japan’s deep waters also meant that offshore projects will likely focus around floating offshore wind power technology, which still remains fairly nascent to date. About 80% of the country's offshore wind potential have sea-depths deeper than 100m.

The technology would provide greater flexibility in locations, but is much costlier than the established fixed-bottom technology, which means that a substantial amount of government support will be needed to commercialise it. Further, Japan will also have to contend with adverse weather events such as typhoons.

However, government support for the wind sector is expected to remain conservative, based on experiences with the solar and biomass sectors. Due to an overwhelming capacity boom following incentives to kickstart these sectors, the government scaled back on its support. Afterwards, the transition toward an auction system for these sectors have underperformed.

“Furthermore, the government’s focus on trying to reduce electricity costs might limit its capacity to dish out subsidies and financial incentives in a similar way that it did for its solar and biomass sectors in the past,” the report stated.

Advertise

Advertise