China Shenhua Energy Co.'s volume recovery finally underway

Following production cuts in 1Q15.

Shenhua's full results release highlights two key themes for its operations.

According to a research note from Barclays, the first is that volume recovery is underway across the businesses after the steep production cuts in 1Q.

Second, cost optimization efforts are gathering pace especially in coal. These were reflected in the 18% operating profit q/q increase in 2Q15, while benchmark coal prices saw a sharp decline in the quarter.

Cash flow also performed better than expected with operating cash flows doubling q/q to RMB20.1 billion. Capex was lower than expected (and -50% y/y), helping free cash flow generation.

Barclays believes that underlying profitability for Shenhua has bottomed and bottom-up improvement in key operating metrics coupled with stabilization in coal prices will help the downgrade cycle to abate. Valuations for H-shares, however, are pricing in the coal business at negative value, which Barclays believes is excessively punitive.

Here's more from Barclays:

Coal – cost optimization gathers pace: COGS for the coal business in 2Q'15 declined 19% y/y, which was ahead of our estimate for a 4% y/y decline. YTD decline in coal business COGS is running at 9%. Accelerated cuts in costs were supported by better than expected coal ASPs at RMB317/t in 2Q15, 12% ahead of our estimates at RMB275/t. The company has maintained its full-year guidance for coal production and sales, while the run rate in last three months implies a small upside to the full-year guidance.

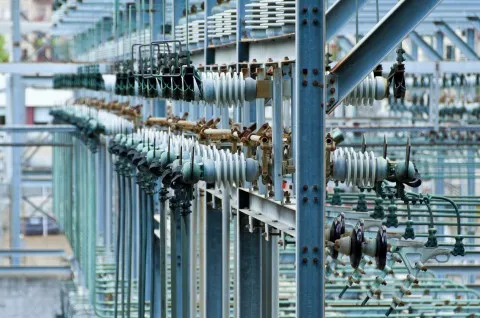

Power – capacity addition to accelerate in 2H: COGS for the power business declined 15% y/y in 2Q15, which is the largest quarterly decline since 2013. Power ASPs were in line with our estimates at RMB333/MWh. Importantly, the company has maintained its power dispatch guidance, which implies a 28% increase in power volumes in 2H compared to 1H. The increase in power generation will likely be supported by commissioning of new plants, which is skewed towards 2H'15.

Logistics – volume recovery in 2Q: Railway volumes have recovered 27% q/q in 2Q15. Importantly, the run rate in July implies further narrowing of the decline to 1% y/y compared to 7% y/y decline in 2Q15. Among the major projects, the Zhunchi line will be put into put into full scale trial operation in the second half of the year. The progress of the construction of Huangda Railway remains on track.

Advertise

Advertise