These 3 Korean gencos could be the biggest losers in capacity utilisation

No thanks to their weak cost competitiveness.

Moody's recently published a report on the credit quality of power generators in Korea and revealed that lower oil and LNG prices will reduce wholesale power prices for power generators.

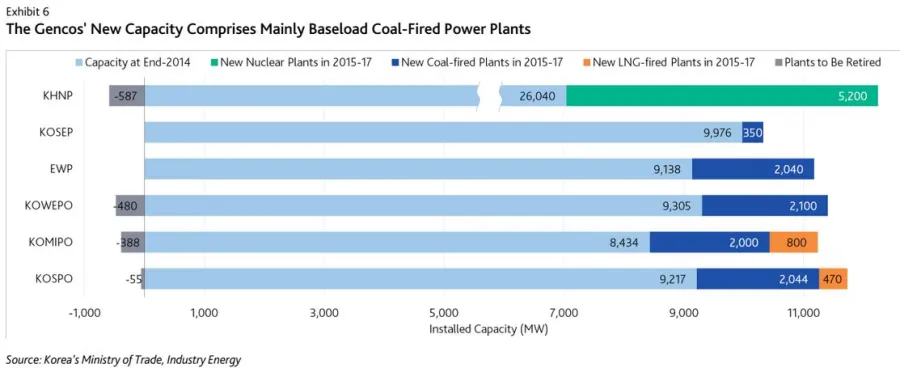

In addition, the supply of electricity from baseload nuclear reactors and coal-fired power plants with less expensive fuel costs will likely grow by around 10% per annum on average over the next 2-3 years, exceeding our annual demand growth forecast of 2%-3% over the same period.

Here's more from Moody's:

While baseload power plants will likely continue to maintain a capacity utilization rate of 80%-85% over the next 12-18 months, we expect the utilization rate of gas- and oil-fired power plants will decline to 30%-40%, from around 50% in 2014.

Gas- and oil-fired power plants account for more than 45% of the total capacity mix for the power generators – except for Korea Hydro and Nuclear Power Company, Korea South-East Power Company, and Korea East-West Power Company – and will lead to the generators recording lower capacity utilization rates.

Private IPPs will be most affected, because almost all of their power plants are fuelled by LNG.

Among the six gencos, KOSPO (Korea South-East Power Company), KOMIPO (Korea Midland Power Company), and KOWEPO (Korea Western Power Company) will likely see the largest decline in capacity utilization over the next 12-18 months, owing to their weaker cost competitiveness, stemming from a lower proportion of baseload power plants in their capacity mix.

The three gencos' coal-fired power plants accounted for 40%-50% of their capacity fuel mix as of 30 September 2015, as opposed to around 90% for KOSEP and 57% for EWP. KHNP's capacity is composed of nuclear reactors (80% of its total capacity) and hydro (20%).

That said, the competitiveness of the three gencos will improve, given that they are scheduled to commission most of their new baseload coal-fired power plants in 2016-17

Advertise

Advertise