Bloomberg report predicts coal, gas to stay cheap

But renewables' cost still trump others.

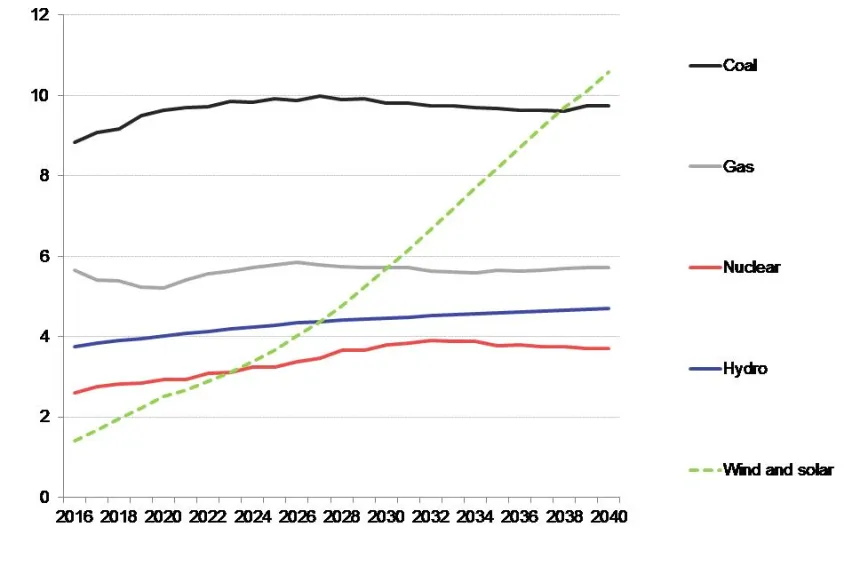

According to the latest long-term forecast from Bloomberg New Energy Finance, entitled New Energy Outlook 2016, low prices for coal and gas are likely to persist, but will fail to prevent a fundamental transformation of the world electricity system over coming decades towards renewable sources such as wind and solar, and towards balancing options such as batteries.

The report charts a significantly lower track for global coal, gas and oil prices than did the equivalent projection a year ago. Crucially, however, it also shows a steeper decline for wind and solar costs.

Here's more from the report:

The forecast, covering the 2016-40 period, has mixed news on carbon emissions. Weaker GDP growth in China and a rebalancing of its economy will mean emissions there peak as early as 2025. However, rising coal-fired generation in India and other Asian emerging markets indicate that the global emissions figure in 2040 will still be some 700 megatonnes, or 5%, above 2015 levels.

Seb Henbest, head of Europe, Middle East and Africa for BNEF, and lead author of NEO 2016, commented: “Some $7.8 trillion will be invested globally in renewables between 2016 and 2040, two thirds of the investment in all power generating capacity, but it would require trillions more to bring world emissions onto a track compatible with the United Nations 2°C climate target.”

Here are some of the eye-catching findings from NEO 2016:

Bloomberg New Energy Finance has reduced its long-term forecasts for coal and gas prices by 33% and 30% respectively, reflecting a projected supply glut for both commodities. This cuts the cost of generating power by burning coal or gas.

The levelised costs of generation per MWh for onshore wind will fall 41% by 2040, and solar photovoltaics by 60%, making these two technologies the cheapest ways of producing electricity in many countries during the 2020s and in most of the world in the 2030s.

Investment in coal and gas generation will continue, predominantly in emerging economies. Some $1.2 trillion will go into new coal-burning capacity, and $892 billion into new gas-fired plants.

Some $7.8 trillion will be invested in green power, with onshore and offshore wind attracting $3.1 trillion, utility-scale, rooftop and other small-scale solar $3.4 trillion, and hydro-electric $911 billion.

Jon Moore, chief executive of Bloomberg New Energy Finance, said: “The New Energy Outlook incorporates a significantly lower trajectory for coal and gas prices than the 2015 edition did a year ago but, strikingly, still shows rapid transition towards clean power over the next 25 years.”

Elena Giannakopoulou, senior energy economist on the NEO 2016 project, added: “One conclusion that may surprise is that our forecast shows no golden age for gas, except in North America. As a global generation source, gas will be overtaken by renewables in 2027. It will be 2037 before renewables overtake coal.”

Advertise

Advertise