Cost overruns threaten Korea's large-scale wind, solar projects

Project delays at construction stage also loom ahead.

Moody's Investors Service says that Korea's increasing focus on renewables, and particular on solar and wind power, will drive growth in the country's renewable sector over at least the next three to five years.

"The Korean government's aim to increase generation from renewables to 20% of total generation by 2030 from 5%-6% in 2016 will likely mean capacity expansion of 40-60 gigawatts for new solar and wind power from around 5 gigawatts at end-2016," says Mic Kang, a Moody's Vice President and Senior Analyst.

The estimated capacity for new solar and wind power is based on Moody's assumption that growth in Korea's power demand will be minimal, while plant load factors for new projects will remain similar to historical averages.

Here's more from Moody's:

The Korean government's plan to expedite the development of renewables is consistent with its commitment to reduce carbon emissions under the Paris Agreement, as well as with its aim to gradually reduce its reliance on coal and nuclear power.

Specifically, the government will likely require non-renewable power generators to produce a greater proportion of power from renewables.

In January 2017, the government also introduced long-term fixed settlement prices for solar and wind, which will support the feasibility of solar and wind projects, via bilateral contracts with the six generation subsidiaries (gencos) of Korea Electric Power Corporation.

Moody's estimates that the government's targeted capacity expansion in solar and wind power by 2030 will require a total investment of KRW100 trillion-KRW130 trillion over the next 12-13 years.

The gencos will lead the government's initiatives, owing to their key policy role and increasing exposure to carbon transition risk.

At the same time, private sector participation in renewable developments -- for example through project finance -- will be increasingly important, given the significant funding needs. The government aims to boost private sector participation in renewable developments by easing various regulations.

"Despite improving business conditions, major credit risks, particularly for large-scale solar and wind projects, will come from potential cost overruns and project delays at the construction stage mainly as a result of civil complaints," adds Kang.

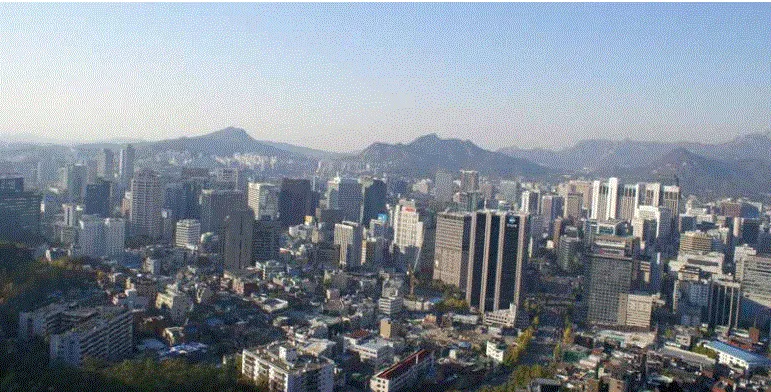

As such, procurement of project sites with manageable construction risk will be crucial for the viability of Korea's projects, particularly given the country's high population density and the prevalence of mountains.

Renewable developments will likely erode KEPCO and the gencos' credit strength, owing to the huge funding needs, and their growing exposure to execution risk.

That said, the capital cost of new renewable energy capacity has been declining, owing to greater economies of scale and improving efficiencies associated with equipment for solar and wind.

The potential adverse impact from renewable developments will also be manageable over the next two to three years as the capacity expansion in wind and solar power will be gradual. In addition, KEPCO and the gencos will receive incremental cash flows from new nuclear and coal power plants under construction and new solar and wind farms.

Independent power producers (IPPs), mostly with liquefied natural gas (LNG) powered plants, will likely face higher curtailment risk for dispatch over the next three to four years because of increasing generation from renewables, as well as new coal and nuclear power.

In the longer term, however, the IPPs should benefit from high dispatch volumes, because LNG power plants can rapidly ramp up during low output from renewables and cover part of the decreasing generation from nuclear or coal power, and/or new power demand.

Advertise

Advertise