News

First Solar's decision to halt project worries Vietnam

First Solar's decison to halt the construction of the solar panel in Ho Chi Minh City has raised a worry that it may stop investing in Vietnam or narrow the project scale.

First Solar's decision to halt project worries Vietnam

First Solar's decison to halt the construction of the solar panel in Ho Chi Minh City has raised a worry that it may stop investing in Vietnam or narrow the project scale.

SN Power to act acquire Vietnam hydropower assets

SN Power, a Norwegian government-controlled renewable energy developer, is aiming to become an industrial investor in Vietnam within the next two years by targetting local hydropower assets.

Development banks to withdraw support for India’s PV sector

The US Government-sponsored banks that have helped fund the takeoff of India’s fledgling solar industry may soon move to withdraw their support, according to an official at the Overseas Private Investment Corporation (OPIC). Peter Ballinger, OPIC’s director, has said that the agency is rapidly approaching its lending limit for PV projects in India and opined that multilateral lenders like the Asian Development Bank (ADB) and the World Bank (WB) could shortly be forced to reassess their aid packages. The ADB, WB and OPIC were among the first to invest in developing solar in India. However, such has been the success of the investment programme that projects in the country now account for 8.5% of OPIC’s total loan book, nearing its 10% limit for any one country. India hopes to complete its first round of large-scale PV installations by January, and is planning to hold an auction for a further 350MW of projects later this month. In October Moser Baer installed India’s largest system to date, a 30MW system in the state of Gujarat, and national capacity now stands at 125MW. Ballinger believes that, with the industry maturing, the time is right for development banks to start withdrawing support. “We’re supposed to be catalytic for new industries by providing financing at an early stage until more traditional lenders get comfortable with the risks of new technologies and businesses they’re unfamiliar with,” he said. “It may be time for commercial banks to step in to India’s solar sector now that it appears to be ramping up."

China Resources Power's net generation up 10.3% in October 2011

Total net generation for the first ten months of 2011 increased by 19.9% to 92,398,706 MWh.

Rallies against nuke plants held in Fukuoka

Anti-nuclear protesters held a series of large rallies in Japan's southwestern city of Fukuoka on Sunday.

New Thai Power Plant to Help Meet Growing Demand for Electricity

The Asian Development Bank (ADB) is lending $170 million to build a new power plant in Thailand that will provide clean, affordable electricity to help meet the country’s increasing demand for supply. “This is the first large independent power producer (IPP) project to reach financial close in Thailand since the 2008 global economic crisis,” said Daniel Wiedmer, Investment Specialist in ADB’s Private Sector Operations Department. “It incorporates state-of-the-art technology to generate electricity far more efficiently than coal fired systems, which are the only domestic alternative for IPPs.” The 1,600 megawatt natural gas-fired plant, which will be built in Nong Saeng district north of Bangkok under a public private partnership arrangement, will help meet Thailand’s rapidly increasing appetite for electricity. By using clean burning, combined cycle technology to curb harmful carbon releases, the plant will avoid an estimated five million tons of annual carbon dioxide emissions that would otherwise be produced by coal-fired generators. Affordably priced power is crucial for supporting Thailand’s post global crisis economic rebound, for making Thai businesses competitive, and for expanding livelihood opportunities to help reduce poverty. A subsidiary of J-Power?Japan’s largest wholesale power supplier?will develop and operate the plant, with the electricity to be sold to the state-owned Electricity Generating Authority of Thailand under a 25-year power purchase agreement. Thai energy firm PTT Public Company will supply the gas, and a group of companies led by Japan’s Mitsubishi Heavy Industries will build the facilities. ADB’s participation and willingness to provide a long-term loan helped draw co-lending support from commercial banks at a similar tenor. The availability of long dated finance gives J-Power the ability to pay down the plant’s high upfront costs over a longer term, allowing it to provide low-cost energy to consumers in Thailand. ADB is heavily involved in clean energy development in Thailand where it is helping to finance two private sector solar power projects, including one of the world’s largest solar photovoltaic plants in Lopburi. Alongside the investment by J-Power and ADB’s 23-year loan, the Japan Bank for International Cooperation and commercial banks – Mizuho Corporate Bank, Ltd., KASIKORNBANK PCL, and Siam Commercial.

ADB lends $170M for Thai power plant

The Asian Development Bank is lending $170 million to build a 1,600MW natural-gas fired power plant in Thailand.

India working to improve windmill maintenance

India boosted its wind power maintenance technology by creating lubricants and sealants that helps windmilsl function properly.

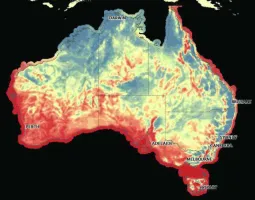

S&P:Austalia's carbon tax to push polluters to change portfolio mix

Standard & Poor's Ratings Services said that there was no immediate impact on its ratings on Australian utility companies following Australia's carbon tax legislation to be implemented from July 1, 2012.

China warns against US blame on its solar exports

Chinese people and enterprises are greatly dissatisfied about U.S. attempts to blame Chinese exports for its sluggish development, according to Ministry of Commerce spokesman Shen Danyang. Shen warned in the statement posted at the ministry's website that United States' anti-dumping and anti-subsidy probe into Chinese exports of solar panels could damage energy cooperation between the two countries and impede the progress of global efforts to deal with climate change. China reserves the right to adopt corresponding measures within the framework of the World Trade Organization, Shen said. The U.S. Department of Commerce said Wednesday that it will conduct an investigation to determine whether Chinese companies have been selling solar panels in the United States at unfair discounts and receiving illegal government subsidies. The U.S. probe would not only hurt Chinese solar panel enterprises, but also hamper U.S. exports to China, said Zhan Jie, a new energy analyst with Huachuang Securities. For the source of this story, please click here.

NPCIL to set up nuke plants with NALCO

Nuclear Power Corporation of India Ltd. and National Aluminium Company Limited have formed a Joint Venture to set up nuclear power plants across the country.

Wind power left out of Australia's clean energy funding?

More than A$13 billion in government funds may be invested by Australia for clean energy that could boost large solar power stations.

India expects to have 2 GW solar capacity by 2013

India plans to have two gigawatts of solar power generation capacity by March 2013.

Vietnam's electricity rate hike put on hold

Electricity rates in Vietnam will remain unchanged this month, according to Deputy Prime Minister Hoang Trung Hai.

Norway- based REC: India favors local manufacturers

Renewable Energy Corporation said it was unlikely to set up its manufacturing presence in Indiadue to unfavorable government policies.

JSW Energy loses a whopping 1.09b rupees in Q2 2011

Blame it on the 8.7% decline in the rupee.

Essar Energy to commission 1 power projects by March 2012

Essar Energy Monday said it expects to complete three power projects by March next year that would increase its total generation capacity to 4,510 Mw. The company, a part of Ruias-led conglomerate Essar group, is also planning to float a sponsored ADR programme this year that would allow American investors to trade in Essar Energy shares. London-listed Essar Energy also has interests in oil and gas and owns the Vadinar oil refinery in Gujarat. “In Power, we expect to commission three projects, Mahan I, Salaya I and Vadinar P2, by end March 2012 which will increase our total generation capacity by 2,910 MW to 4,510 MW,” Essar Energy said in its interim management statement for the period ended September 30. “We expect to complete a further 7 power generation projects by the end of March 2014 to take our total generation capacity to 9,670 MW,” it noted. The 1,200 MW Salaya I and 510 MW Vadinar P2 projects are located in Gujarat while Mahan I is in Madhya Pradesh. According to the statement, the company is looking to initiate American Depository Receipt (ADR) programme, for which BNY Mellon has been appointed as the depository bank. “To further enhance the ability of a wide range of institutions to invest in Essar Energy, the company has decided to establish a Level 1 (Over-The-Counter) sponsored ADR programme. “… it is expected that the ADR programme will be in place before the end of 2011, opening up a new source of potential investors in Essar Energy,” it said. When contacted, an Essar spokesperson said the proposed ADR programme is just to allow US investors to trade in Essar Energy shares and that there would not be any kind of share issue or raising capital. As on September, Essar Energy’s net debt stood at USD 5,507 million, which is in line with its plans.

Advertise

Advertise