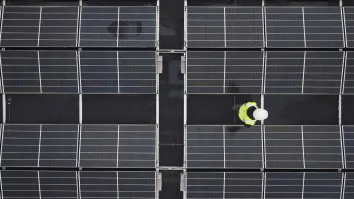

Hudson fund to invest in China clean energy market

Hudson Clean Energy Partners aims to raise its first yuan-denominated fund, the largest of its kind, to invest in China's rapidly expanding clean energy market.

Hudson, a U.S. cleantech private equity fund, which manages a $1 billion clean tech equity fund in the United States, is bullish on China's clean energy markets with urbanization, rising pollution and a tremendous hunger for energy expected to drive demand for clean energy.

"We view China as the world's most important market in clean energy, witnessing a continuation of a boom that began five years ago and look set to continue well into the future," Hudson co-managing partner Neil Auerbach told Reuters.

Hudson, which invests exclusively in clean energy, is setting up its China fund with the municipal government of Yangzhou, a city located in Jiangsu, one of China's most affluent provinces.

Hudson aims to launch the fund by year-end, although said the actual timing would depend on government approvals.

Advertise

Advertise